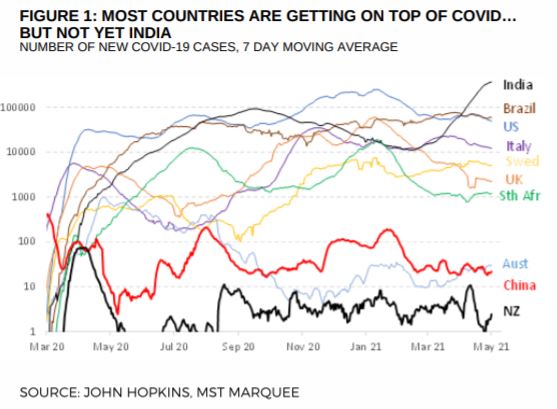

Through a combination of social distancing, more effective treatment, and vaccines, we find the number of new COVID-19 cases has been declining around the world. Of course, there are some notable exceptions like India where the virus continues to ravage communities and is currently responsible for more than 3500 deaths every day. Other exceptions include Argentina, Iran and, Iraq where the number of new COVID-19 cases continues to rise.

While the stories of the pandemic in these more affected locations are heart-wrenching, the impact on the Australian economy, and global financial markets, has been limited for the time being. More important for Australia is the containment of the virus in economies like the US, UK, China and, New Zealand. In the US and UK we find the inoculation programs are well progressed and populations are on the verge of herd immunity. In China, there has been almost 300m vaccines administered but there is also much less incidence of the virus. Meanwhile, in New Zealand we find just 4% of the population has received at least one dose of the vaccine. Still, the domestic economy has been recovering strongly with the help extraordinary stimulus measures and containment of the virus.Relative to the rest of the world, Australia has so far had a ‘good-pandemic’. The early closure of borders and the draconian measures taken during outbreaks have been jarring, but have served the community well. There are virtually no locally transmitted cases in Australia.

However, early success in dealing with the virus could have delayed our governments haste in preparing for the vaccine roll-out which has stalled. When compared to say the US, Australia was too slow in ensuring doses of the vaccines and have taken a too narrow a focus in which vaccines to use. Previously we expected herd immunity in Australian to be achieved in the September quarter. Now this could be too ambitious and early 2022 could be more likely.

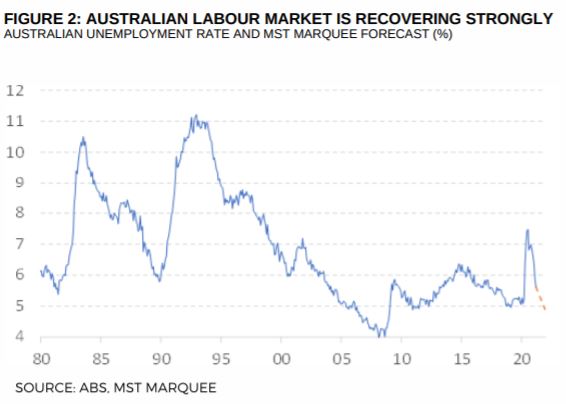

In aggregate, the global economy appears to be booming. However, the strong headline growth mask a mix of momentum around the world. Economic activity in both China and US has recovered to above pre-pandemic levels. China surpassed this level in 2020 and the US in 1Q21. In both economic superpowers the recovery has been fueled by uber accommodative policy and control of the virus. The growth in the US economy has been focused in consumption. Households, flush with savings built up during the pandemic and handouts from the government, are spending at a ferocious rate. This includes spending on houses and housing products.

While China and the US are leading the world recovery, Continental Europe is lagging. The euro-zone region has endured a double dip recession — that is four quarters of GDP contraction in the last five — and has been weighed down by a slow vaccine roll-out. The virus has also compounded structural impediments to European growth which includes a financial system which has not really recovered from the financial crisis 10-years ago and, weak population growth.

Recent consumer price inflation readings have been strong in some economies, but we do not think it will be the start of a sustained period of high inflation. Some of the recent surprises in consumer prices have come from components which we think are either unlikely to repeat or poised to reverse. For now, it appears to be base-effects and bottlenecks driving prices higher but these are unlikely to be sustained. There remain structural headwinds to inflation and these include an aging population, globalisation and technology.

An older population is an especially powerful headwind for prices. Older people are not retiring as early as they once did and instead remaining in the workforce. This has been to detriment of the promotion prospects and wage increases of younger people. The current rise in consumer prices will prove to be fleeting, in our view.

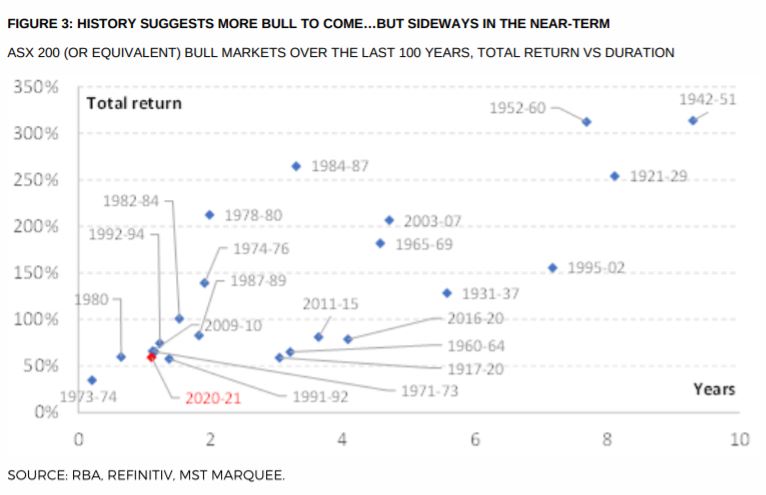

While the current bull market remains in its early stages, when compared to the 22 others in Australia over the last 100 years, we expect a period of consolidation in stock indices ahead. Checking our bullishness is a combination of unwinding policy support, equity valuations back to fair and, a level of complacency forming in equity markets. Investors should also expect bond yields to rise further and this will be a moderate headwind for stock markets. We stick to our view that the ASX 200 will finish the year at 7000. We expect sideways markets during the months ahead.

Within the market we continue our tilt to value stocks. These companies generally trade on lower valuation multiples and we expect rising bond yields and discount rates will not be major impediment here. We also remain over exposed to companies expected to benefit as economies continue to reopen after the pandemic. In Australia this includes Qantas, Ramsay Healthcare, REA, Downer, SkyCity Entertainment and United Malt.

The banks have been an area we have avoided and we have preferred to gain our ‘COVID-recovery’ exposure in other areas. While the banks have been a good trade, we think they will make poor investments. The companies remain over exposed to housing finance and Australian households continue to be some of the most financially leveraged in the world. High financial leverage should impinge on loan growth which we think will remain anemic. Instead of the banks, income seeking investors should consider companies like Macquarie Group and Amcor where the dividend yield is sold and set to grow sustainably from current levels.

US equities are more vulnerable in a world of rising bond yields, in our view. The US equity market is the most highly valued major market on Cyclically Adjusted PE of 40x (vs 21x for Australia) and may also be most susceptible when discount rates rise. There is a period of

consolidation ahead for global equities and the US market could struggle to outperform. To mitigate the risks, US focused investors should tilt towards cheaper companies and/or those which enjoy strong EPS momentum. The mega-cap technology stocks are awesome cash machines that continue to grow so the dangers here are perhaps more moderate than less proven business models.

MST Marquee outlines that the securities and industries covered in this report, are exposed to broader risks associated with operational, competition,

economic, and political factors. MST Marquee points out, that these factors carry ongoing risk of change and variation, which cannot be accurately forecast or anticipated in all instances. These risks apply to both earnings forecasts and target price. The price and value of investments mentioned and any income that might accrue could fall or rise or fluctuate. Past performance is not a guide to future performance.

This report has been prepared in an independent manner. In uploading the report to the MST Marquee webpage, the analysts certify that the views and

opinions expressed within this report accurately represent their personal views on the subject matter and securities covered in this report. The analysts have not received direct or indirect compensation related to the views or recommendations contained herein.

MST Marquee research is published in accordance with our conflict management policy which is available at: https://www.mstmarquee.com.au/

The information and opinions contained within MST Marquee Research were prepared by MST Financial Services Pty Ltd (ABN 54 617 475 180, AFSL

500557) (‘MST’).

MST Marquee Research is distributed only as may be permitted by law. It is not intended for distribution or use by any person or entity located in a jurisdiction where distribution, publication, availability or use would be prohibited. MST makes no claim that MST Marquee Research content may be lawfully viewed or accessed outside of Australia. Access to MST Marquee Research content may not be legal for certain persons and in certain jurisdictions. If you access this service or content from outside of Australia, you are responsible for compliance with the laws of your jurisdiction and/or the jurisdiction of the third party receiving such content. MST Marquee Research is provided to our clients through our proprietary research portal and distributed electronically by MST to its MST Marquee clients. Some MST Marquee Research products may also be made available to its clients via third party vendors or distributed through alternative electronic means as a convenience. Such alternative distribution methods are at MST’s discretion.

Any access to or use of MST Marquee Research is subject to the Terms and Conditions of MST Marquee Research https://www.mstmarquee.com.au/LiteratureRetrieve.aspx?ID=182307. By accessing or using MST Marquee Research you hereby agree to be bound by our Terms and Conditions and hereby liable for any monies due in payment of accessing this service. In addition you consent to MST collecting and using your personal data (including cookies) in accordance with our Privacy Policy https://www.mstfinancial.com.au/privacy-policy, including for the purpose of a) setting your preferences and b) collecting readership data so we may deliver an improved and personalised service to you. If you do not agree to our Terms and Conditions and/or if you do not wish to consent to MST’s use of your personal data, please do not access this service.

MST Marquee Research is not intended, nor does it constitute a representation that an investment strategy or recommendation is suitable or appropriate

for an investors individual circumstances. MST Marquee Research may not be construed as personal advice or recommendation. MST encourages

investors to seek independent financial advice regarding the suitability of investments for their individual circumstances and recommends that investments be independently evaluated.

Investments involve risks and the value of any investment or income may go down as well as up. Investors may not get back the full amount invested. Past performance is not indicative of future performance, and no representation or warranty, express or implied, is made regarding future performance. Estimates of future performance are based on assumptions that may not be realised. If provided, and unless otherwise stated, the closing price provided is that of the primary exchange for the issuer’s securities or investments. Information, opinions and estimates contained in this report reflect a judgment at its original date of publication and are subject to change without notice. The price, value of and income from any of the securities or financial instruments mentioned in this report can fall as well as rise. The value of securities and financial instruments is subject to exchange rate fluctuation that may have a positive or adverse effect on the price or income of such securities or financial instruments. MST assumes no obligation to, update this document or correct any inaccuracy which may become apparent after it is given.

The information contained within MST Marquee Research is published solely for information purposes and is not a solicitation or offer to buy or sell any financial instrument or participate in any trading or investment strategy.

Analysis contained within MST Marquee Research publications is based upon publicly available information and may include numerous assumptions. Investors should be aware that different assumptions can and do result in materially different results. Whilst MST makes every effort to use reliable,

comprehensive information in the construction of its reports. MST makes no representation, warranty or undertaking of the accuracy, timeliness or

completeness of information provided to it by third party providers.

Save for any statutory liability that cannot be excluded, MST and its employees, representatives and agents shall not be liable (whether in negligence or otherwise) for any error or inaccuracy in, or omission from, this advice or any resulting loss suffered by the recipient or any other person.

Coverage by MST Marquee Research, including whether to initiate, update or cease coverage of an issuer or sector, is at the sole discretion of the Analyst providing the service.

MST Marquee Research personnel may participate in issuer events such as site visits and are prohibited from accepting payment by the issuer of associated expenses unless pre-authorised by MST.

The research analysts principally responsible for the preparation of MST Marquee Research have received compensation based upon direct client contracting.

For important stock specific disclosures, stock price charts and equity rating histories, please see our website at https://www.mstmarquee.com.au/

Copyright of the information contained within MST Marquee Research (including trademarks and service marks) are the property of their respective owners.

MST Marquee Research, or any portion thereof, may not be reprinted, sold or redistributed without the prior and written consent of MST.