There have been around 20 million recorded coronavirus infections around the world and authorities indicate the actual number could be up to 10 times this amount. The number of recorded coronavirus deaths is closing in on 1 million. The virus has been especially infectious in the US, South America and the Middle-east where we have seen signs of either a second wave, or no abatement of the first wave. Worryingly, the rate of contagion is beginning to climb once again in Europe too.The 2nd wave of the virus in the US is weighing on measures of consumer confidence and it looks to be stalling the normalisation on consumption. People were beginning to venture back onto domestic flights, enjoy restaurants and stay in hotels, but all of this has stopped, at least for now. The virus has also brought with it a stall in the sharply recovering labour market. The fear of course is that some of these job losses will become permanent and the global economy will endure a reduction in its productive capacity for some time to come. The 2nd wave of the pandemic is once again doing its best to drag the world into depression.

However, there appears to be a ray of hope. The number of new infections in the US has very recently begun to decline. While still early days, the rate of infection appears to be peaking in South America and India as well. In Sweden, which was the country which adopted more of a herd-immunity approach and avoided the severe lockdowns as we had elsewhere, They have enjoyed a steady reduction in the number of new cases for several weeks. We suspect one of the reasons for the decline in the level of contagion is that humans are learning to live with the virus. Masks are now common in many countries. Handshakes are out and elbow clicks are in. The elderly and those more susceptible to the virus have taken extra precautions. While humanity is still some way away from what was normal, we are beginning to control the spread of the virus.

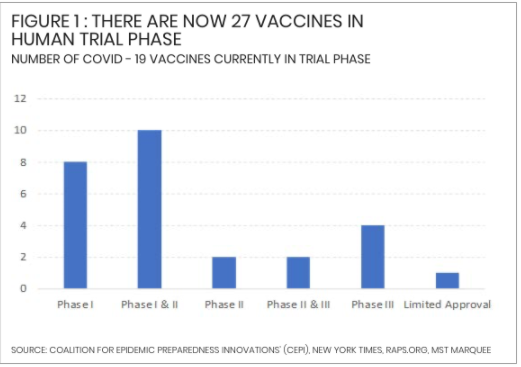

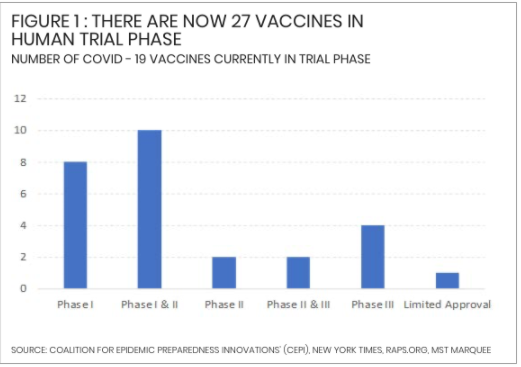

2021. The company is associated with the vaccine being trialled by Oxford University and Astra Zeneca.We find there are around 200 potential vaccines in development and 27 of these are now in human trial. There has never been such a concentrated push by the global pharmaceutical industry. We suspect investors need to be prepared for a steady flow of good news on potential vaccines and the success of their trials.Of course, a vaccine will have profound implications on the global economy and financial markets. First, it will improve the prospects for the economy and broaden the current recovery taking place.

Australia was within a finger-nail from essentially eradicating the virus, the same way New Zealand has done. In New Zealand we understand domestic flights are now full, as are restaurants. However, an outbreak, stemming from Melbourne and since spreading to other parts of the country, have put an end to hopes of the same in Australia, for now.

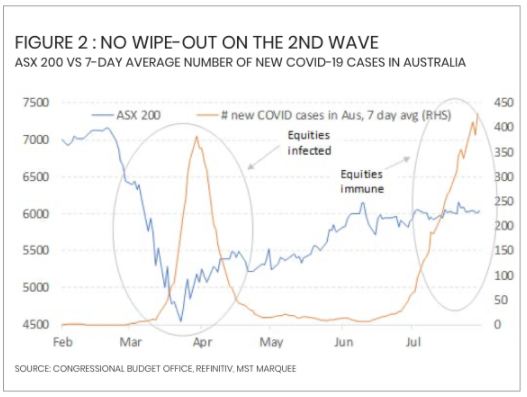

At stage 4 restrictions, Melbourne is currently undergoing the most stringent lock-down conditions of any major city in the world. Despite the brutal response by authorities to contain the virus, it seems that equity markets have become immune to it. Unlike the 1st wave of the virus which sparked a precipitous sell-off in Aussie equities, the 2nd wave has been seen little response by the stock market.

Perhaps this is because investors know the lockdown conditions will be temporary. Maybe equities have held up because the first wave taught us that businesses can still operate with the virus with more of it moving online and home delivered.

It could be because policy makers have undertaken extraordinary efforts to essentially inoculate financial markets from the real economy.

We would also suggest the potential of a vaccine is ahead of investors and many don’t want to be on the wrong side of this coming trade.

There have been around 20 million recorded coronavirus infections around the world and authorities indicate the actual number could be up to 10 times this amount. The number of recorded coronavirus deaths is closing in on 1 million. The virus has been especially infectious in the US, South America and the Middle-east where we have seen signs of either a second wave, or no abatement of the first wave. Worryingly, the rate of contagion is beginning to climb once again in Europe too.The 2nd wave of the virus in the US is weighing on measures of consumer confidence and it looks to be stalling the normalisation on consumption. People were beginning to venture back onto domestic flights, enjoy restaurants and stay in hotels, but all of this has stopped, at least for now. The virus has also brought with it a stall in the sharply recovering labour market. The fear of course is that some of these job losses will become permanent and the global economy will endure a reduction in its productive capacity for some time to come. The 2nd wave of the pandemic is once again doing its best to drag the world into depression.

However, there appears to be a ray of hope. The number of new infections in the US has very recently begun to decline. While still early days, the rate of infection appears to be peaking in South America and India as well. In Sweden, which was the country which adopted more of a herd-immunity approach and avoided the severe lockdowns as we had elsewhere, They have enjoyed a steady reduction in the number of new cases for several weeks. We suspect one of the reasons for the decline in the level of contagion is that humans are learning to live with the virus. Masks are now common in many countries. Handshakes are out and elbow clicks are in. The elderly and those more susceptible to the virus have taken extra precautions. While humanity is still some way away from what was normal, we are beginning to control the spread of the virus.

Moderna, a Boston based drug company, recently highlighted the success in its Phase II trials. It has now begun Phase III trials where the drug will be tested upon thousands of people. Meanwhile, Pfizer’s CEO noted …”it is a matter of when, not if, a vaccine will be delivered”. If all goes well, Pfizer expects their vaccine, produced in-conjunction with BioNTech in Germany, will be approved this year.Meanwhile Bill Gates highlighted, in a letter to the South Korean president, that SK Bioscience may be able to manufacture 200 million doses of a vaccine by June

2021. The company is associated with the vaccine being trialled by Oxford University and Astra Zeneca.We find there are around 200 potential vaccines in development and 27 of these are now in human trial. There has never been such a concentrated push by the global pharmaceutical industry. We suspect investors need to be prepared for a steady flow of good news on potential vaccines and the success of their trials.

Of course, a vaccine will have profound implications on the global economy and financial markets. First, it will improve the prospects for the economy and broaden the current recovery taking place.

Industries which are currently not participating in the macro recovery, like travel and casinos, will do so to a greater extent. A broader and sharper economic recovery will eventually cause reason for central banks to pull-back from their uber accommodative stance. As this happens, we imagine bond yields and interest rates will push higher. Higher returns on risk free assets will provide more competition for equities.

While a vaccine will be brilliant for the real economy, because of rising discount rates, sometime down the path it may not be as positive for financial markets as many people may first believe.

We adopted a more positive position on equities in April and target the ASX 200 index to finish the year at 6500. Further gains should be expected next year as well. Our positive view on markets continues to be predicated on several factors. First, we anticipate the coming end of the profits recession during the August report period.

Australian profits are set to fall 25-30% this cycle. While deep, we believe investors will look ahead an anticipation of an eventual recovery. We continue toforecast a

V-shaped recovery in profits and this should be supported by cost cuts by Australian companies to increase the leverage to future revenue growth.

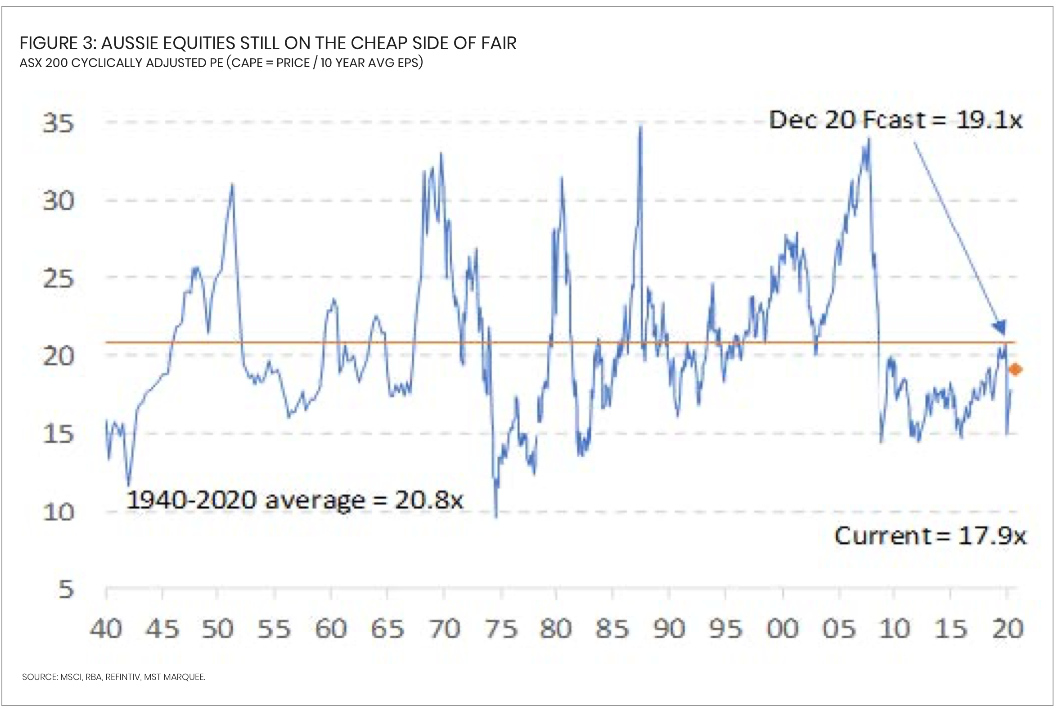

Second, we continue to believe valuations for Aussie equities are on the cheap side of fair. Our preferred valuation measure now is the Cyclically Adjusted PE (CAPE). This is a through the cycle valuation measure and it is simply the ratio of current prices and average EPS over 10-years. Over the long-term the cyclically adjusted PE has averaged 21x and now it is less than 18x. Third, our positive view on the stock-market is also supported by a continuation of the extraordinary easing by policy makers. Central banks around the world have been unanimous in their desire to ease further if needed. This is keeping a lid on discount rates, all while we see the very early stages of recovery.

Within the equity market investors should consider those companies which are more attractively priced and are able to gain as the lockdown measures come off. In Australia this includes the mining companies that sell to China. China was first into the virus and it is also the first country to get back to work. We expect Chinese authorities will ease policy further and continue to embark on infrastructure and real-estate investment. This will be steel intensive, to the delight of our iron pore producers like Rio Tinto and BHP.

Also, we suspect a vaccine will support a faster normalisation of the global economy and investors should not forget some of those companies which have suffered most from the social distancing measures currently in place. This includes the travel companies like Qantas, Flight Centre and, Sydney Airport. Also, it includes the casinos like Crown, Star and SkyCity. In addition, the real estate companies like REA and private hospital operator like Ramsay should benefit as well.

The outlook for the Australian banks continues to remain uninspiring. The various pressures on the business model may mean these giants of the Aussie equity market become minnows over time. The banks are currently under net interest margin pressure, in addition, we believe loan growth will slow in the years ahead. In the US, after the cash crunch of the global financial crisis, households took a more cautious view to their own finances and carried less debt. The cash crunch of the pandemic in Australia could result in the same. With little in the way of interest margin and modest loan growth, we think the banks will struggle to re-rate to previous levels.

MST Marquee outlines that the securities and industries covered in this report, are exposed to broader risks associated with operational, competition,

economic, and political factors. MST Marquee points out, that these factors carry ongoing risk of change and variation, which cannot be accurately forecast or anticipated in all instances. These risks apply to both earnings forecasts and target price. The price and value of investments mentioned and any income that might accrue could fall or rise or fluctuate. Past performance is not a guide to future performance.

This report has been prepared in an independent manner. In uploading the report to the MST Marquee webpage, the analysts certify that the views and

opinions expressed within this report accurately represent their personal views on the subject matter and securities covered in this report. The analysts have not received direct or indirect compensation related to the views or recommendations contained herein.

MST Marquee research is published in accordance with our conflict management policy which is available at: https://www.mstmarquee.com.au/

The information and opinions contained within MST Marquee Research were prepared by MST Financial Services Pty Ltd (ABN 54 617 475 180, AFSL

500557) (‘MST’).

MST Marquee Research is distributed only as may be permitted by law. It is not intended for distribution or use by any person or entity located in a jurisdiction where distribution, publication, availability or use would be prohibited. MST makes no claim that MST Marquee Research content may be lawfully viewed or accessed outside of Australia. Access to MST Marquee Research content may not be legal for certain persons and in certain jurisdictions. If you access this service or content from outside of Australia, you are responsible for compliance with the laws of your jurisdiction and/or the jurisdiction of the third party receiving such content. MST Marquee Research is provided to our clients through our proprietary research portal and distributed electronically by MST to its MST Marquee clients. Some MST Marquee Research products may also be made available to its clients via third party vendors or distributed through alternative electronic means as a convenience. Such alternative distribution methods are at MST’s discretion.

Any access to or use of MST Marquee Research is subject to the Terms and Conditions of MST Marquee Research https://www.mstmarquee.com.au/LiteratureRetrieve.aspx?ID=182307. By accessing or using MST Marquee Research you hereby agree to be bound by our Terms and Conditions and hereby liable for any monies due in payment of accessing this service. In addition you consent to MST collecting and using your personal data (including cookies) in accordance with our Privacy Policy https://www.mstfinancial.com.au/privacy-policy, including for the purpose of a) setting your preferences and b) collecting readership data so we may deliver an improved and personalised service to you. If you do not agree to our Terms and Conditions and/or if you do not wish to consent to MST’s use of your personal data, please do not access this service.

MST Marquee Research is not intended, nor does it constitute a representation that an investment strategy or recommendation is suitable or appropriate

for an investors individual circumstances. MST Marquee Research may not be construed as personal advice or recommendation. MST encourages

investors to seek independent financial advice regarding the suitability of investments for their individual circumstances and recommends that investments be independently evaluated.

Investments involve risks and the value of any investment or income may go down as well as up. Investors may not get back the full amount invested. Past performance is not indicative of future performance, and no representation or warranty, express or implied, is made regarding future performance. Estimates of future performance are based on assumptions that may not be realised. If provided, and unless otherwise stated, the closing price provided is that of the primary exchange for the issuer’s securities or investments. Information, opinions and estimates contained in this report reflect a judgment at its original date of publication and are subject to change without notice. The price, value of and income from any of the securities or financial instruments mentioned in this report can fall as well as rise. The value of securities and financial instruments is subject to exchange rate fluctuation that may have a positive or adverse effect on the price or income of such securities or financial instruments. MST assumes no obligation to, update this document or correct any inaccuracy which may become apparent after it is given.

The information contained within MST Marquee Research is published solely for information purposes and is not a solicitation or offer to buy or sell any financial instrument or participate in any trading or investment strategy.

Analysis contained within MST Marquee Research publications is based upon publicly available information and may include numerous assumptions. Investors should be aware that different assumptions can and do result in materially different results. Whilst MST makes every effort to use reliable,

comprehensive information in the construction of its reports. MST makes no representation, warranty or undertaking of the accuracy, timeliness or

completeness of information provided to it by third party providers.

Save for any statutory liability that cannot be excluded, MST and its employees, representatives and agents shall not be liable (whether in negligence or otherwise) for any error or inaccuracy in, or omission from, this advice or any resulting loss suffered by the recipient or any other person.

Coverage by MST Marquee Research, including whether to initiate, update or cease coverage of an issuer or sector, is at the sole discretion of the Analyst providing the service.

MST Marquee Research personnel may participate in issuer events such as site visits and are prohibited from accepting payment by the issuer of associated expenses unless pre-authorised by MST.

The research analysts principally responsible for the preparation of MST Marquee Research have received compensation based upon direct client contracting.

For important stock specific disclosures, stock price charts and equity rating histories, please see our website at https://www.mstmarquee.com.au/

Copyright of the information contained within MST Marquee Research (including trademarks and service marks) are the property of their respective owners.

MST Marquee Research, or any portion thereof, may not be reprinted, sold or redistributed without the prior and written consent of MST.