Policy makers effectively inoculated financial markets from the virus in March-April last year. The forceful policy response by global central banks, all vowing to do whatever-it-takes to preserve financial markets and support the economy, was the very start of an extraordinary and coordinated policy effort. The monetary and fiscal easing served to keep financial markets buoyant even though the global economy was sinking. Now healthcare professionals around the world have started the process of inoculating people from the virus.

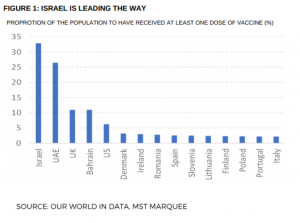

The global inoculation program started in December and now there are just 44m people around the global with at least one dose of the vaccine. This is a small percentage of the global population and highlights the mountain healthcare services will need to climb. Israel is leading the way. With much of the efficiency of its infamous secret service, Israeli authorities have given at least one dose of the Pfizer vaccine to 34% of its population. Early studies in Israel suggest the vaccine is just as effective as it was during Phase III trials – the chances of being infected by the virus collapse 14 days after the initial dose.This could be why the number of new virus cases in Israel have also declined. The 2nd most vaccinated country in the world, United Arab Emirates (UAE), is yet to enjoy a decline in the number of new cases. The UK and US are also amongst the largest vaccinators, but still the proportion of the population with at least one jab is 10% and 6% respectively.

In Australia, the roll-out of the vaccine is expected to start mid to late February. We believe two thirds of the population will be vaccinated by the September quarter which will provide a level of heard immunity. Almost all of the population will have the vaccine by the end of the year.

The success of the vaccine, in combination with uber accommodative fiscal and monetary policy, should ensure the second half of 2021, will be a buoyant time for global economic growth. In the US we expect GDP growth of more than 4% for the year, roughly twice growth rates we would consider trend. The corresponding recovery in the labour market in the US should mean an average of 300k new jobs are created each month in 2021 and a further 250k new jobs in 2022. Job creation in the US will be further supported with yet another round of fiscal expansion where our assumptions have grown since the Democrats took control of congress. We forecast additional fiscal support of around U$1.5t to be legislated over the next year in multiple tranches. In the near term we expect topped up stimulus payments, extended unemployment benefits and direct aid to state and local governments. Later we anticipate expanded healthcare subsidies and infrastructure spending. Fiscal policy has been a key support to income and spending in 2020 and that should continue in 2021-22. Consumers saved a large amount of the initial proceeds from the CARES Act and it fed into spending over time, in part because activity is constrained by the pandemic. We expect consumers to continue smoothing fiscal transfers into spending and for the saving rate to spike again and then come down rapidly but remain somewhat above pre-COVID levels in 2022.

The strength of the US economy through 2021 should mean the central bank will make considerable progress towards its goal of maximum employment and inflation above 2%’. At which time we expect the central to signal a future unwinding of its uber-accommodative stance. While it is still early for authorities to signal less dovish policy now, we expect this to occur in the second half of 2021. In anticipation of stronger growth and less accommodative policy we forecast bond yields will adjust higher. While the increase will be moderate, it should mean a little more competition for equities and slightly lower valuations for the asset class, all other things equal.

While further progress on the economic recovery and potential adjustment away from the current accommodative policy position is ahead of the US, it appears China is already at this point. The virus and the economic downturn happened earlier in China. In addition, Chinese authorities, with their brutal hard lockdown, limited the level of contagion and the economy has been on the path to recovery for several quarters now. Policy is being tightened as well with interest rates and bond yields back up to 2019 levels, liquidity is being withdrawn from money markets and, indicators of money supply are no longer accelerating. The less accommodative stance will likely result in lower growth but for it to be higher quality.

Chinese authorities have made it clear they are happy to forgo some trade with nations to retaliate against aggressive foreign rhetoric. This is the situation Australia finds itself in. Australia’s call for an independent investigation into the origins of COVID-19 clearly upset the current batch of Chinese leadership which considered it a sensitive issue. The stage was set for China to execute on their ‘dual-circulation’ policy where they will be happy to engage with a foreign entity if it helps their economy develop but, where they can, will look to make an example of those countries which take a more aggressive position with the middle kingdom. This clearly means China will be happy to buy industrial goods like iron ore, especially if there is not another reliable supplier. However, China will be less willing to buy consumer goods like wine where global supply is abundant. We are not sure if the China-Australia trade skirmish has peaked, but if it continues, we expect companies selling consumer goods to China will be more at risk.

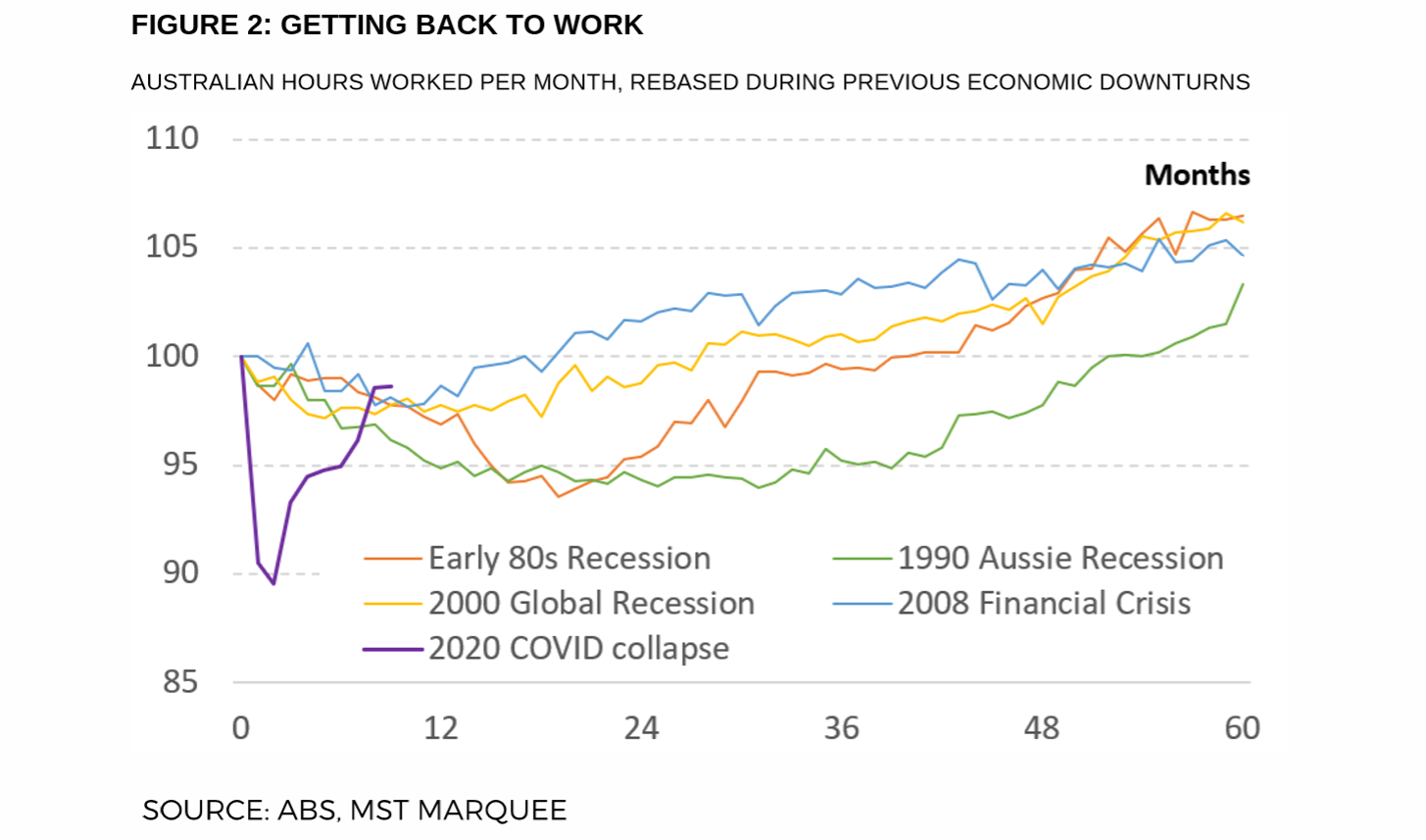

The tyranny of distance has worked in Australia’s favour during the pandemic. Our country has been one of the best in dealing with the virus. Still, policy makers have engaged in some of the largest stimulus measures anywhere in the world, and it is working. The rebound in the Australian labour market this cycle has been the sharpest on record. The participation rate is already back up to pre-COVID levels and we suspect the unemployment rate will be c100 basis point lower by year end. While this won’t be in-line with levels authorities considered to be ‘full-employment’ before the pandemic, it will be amongst the strongest labour markets in the world. The combination of rapid job creation, rising wages, lower interest costs and, healthier household balance sheets should mean stronger consumption growth in Australia. This is currently focused on goods consumption, but we believe it will spread to services as the vaccine is administered and social distancing measures relax.

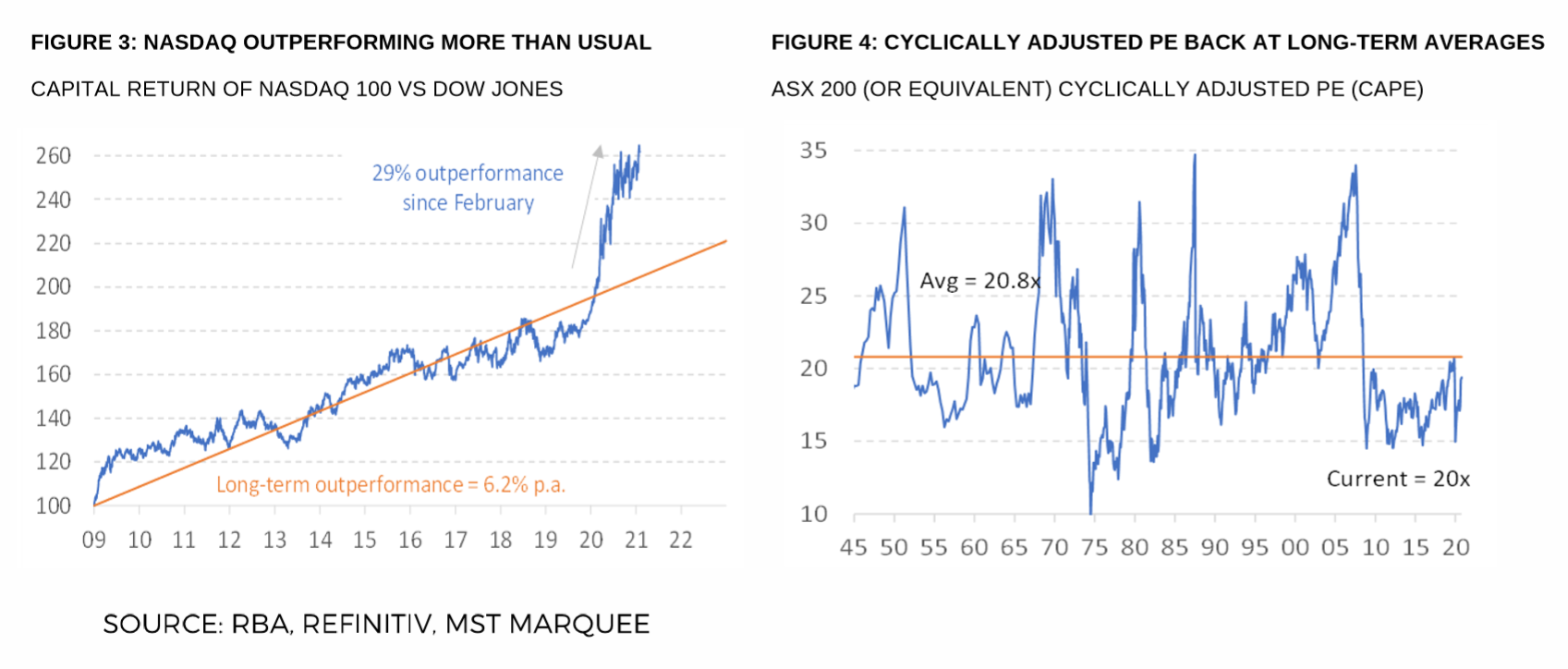

A solid macro backdrop bodes well for the corporate profit outlook and we believe we are at the very early stages of a V-shaped recovery. This will mean +20% profits growth around the world, however the concentration of these gains will be in those companies which suffered most during the pandemic. In the US we can see a situation where the medium term profits outlook for some of the large cap tech companies looks less interesting. Many of these companies did well when the world moved online and could endure relatively slower profits growth when social distancing measures are relaxed. While these companies are still amongst the highest quality in the world – with their enormous cash generation, solid balance sheets and unique competitive position – they could be valued too highly for now.

The Aussie equity market trades on 20x 12-month forward PE and the cyclically adjusted PE ratio (CAPE) is back to average levels. Much of the coming good news on profits is already discounted. While equity valuations still look cheap against bonds, we expect the relative attractions here will diminish through the year as the economic recovery pushes bond yields moderately higher. We stick to our yearend target for the ASX 200 of 7000. This means investors should expect a capital return of just over 6% for the year and a total return of around 10%.

The most ferocious part of the bull market is now behind us. To generate better returns than our market forecast investors should tilt towards cheaper stocks that tend to do well in economic recoveries (Downer, Nine Entertainment, JB Hi-Fi) , COVID recovery stocks (Qantas, Ramsay Healthcare, REA Group, Santos, United Malt), beneficiaries of M&A (Ampol, Boral, Medibank, Tabcorp) and income (Amcor, ANZ, Coles and Origin Energy).

MST Marquee outlines that the securities and industries covered in this report, are exposed to broader risks associated with operational, competition,

economic, and political factors. MST Marquee points out, that these factors carry ongoing risk of change and variation, which cannot be accurately forecast or anticipated in all instances. These risks apply to both earnings forecasts and target price. The price and value of investments mentioned and any income that might accrue could fall or rise or fluctuate. Past performance is not a guide to future performance.

This report has been prepared in an independent manner. In uploading the report to the MST Marquee webpage, the analysts certify that the views and

opinions expressed within this report accurately represent their personal views on the subject matter and securities covered in this report. The analysts have not received direct or indirect compensation related to the views or recommendations contained herein.

MST Marquee research is published in accordance with our conflict management policy which is available at: https://www.mstmarquee.com.au/

The information and opinions contained within MST Marquee Research were prepared by MST Financial Services Pty Ltd (ABN 54 617 475 180, AFSL

500557) (‘MST’).

MST Marquee Research is distributed only as may be permitted by law. It is not intended for distribution or use by any person or entity located in a jurisdiction where distribution, publication, availability or use would be prohibited. MST makes no claim that MST Marquee Research content may be lawfully viewed or accessed outside of Australia. Access to MST Marquee Research content may not be legal for certain persons and in certain jurisdictions. If you access this service or content from outside of Australia, you are responsible for compliance with the laws of your jurisdiction and/or the jurisdiction of the third party receiving such content. MST Marquee Research is provided to our clients through our proprietary research portal and distributed electronically by MST to its MST Marquee clients. Some MST Marquee Research products may also be made available to its clients via third party vendors or distributed through alternative electronic means as a convenience. Such alternative distribution methods are at MST’s discretion.

Any access to or use of MST Marquee Research is subject to the Terms and Conditions of MST Marquee Research https://www.mstmarquee.com.au/LiteratureRetrieve.aspx?ID=182307. By accessing or using MST Marquee Research you hereby agree to be bound by our Terms and Conditions and hereby liable for any monies due in payment of accessing this service. In addition you consent to MST collecting and using your personal data (including cookies) in accordance with our Privacy Policy https://www.mstfinancial.com.au/privacy-policy, including for the purpose of a) setting your preferences and b) collecting readership data so we may deliver an improved and personalised service to you. If you do not agree to our Terms and Conditions and/or if you do not wish to consent to MST’s use of your personal data, please do not access this service.

MST Marquee Research is not intended, nor does it constitute a representation that an investment strategy or recommendation is suitable or appropriate

for an investors individual circumstances. MST Marquee Research may not be construed as personal advice or recommendation. MST encourages

investors to seek independent financial advice regarding the suitability of investments for their individual circumstances and recommends that investments be independently evaluated.

Investments involve risks and the value of any investment or income may go down as well as up. Investors may not get back the full amount invested. Past performance is not indicative of future performance, and no representation or warranty, express or implied, is made regarding future performance. Estimates of future performance are based on assumptions that may not be realised. If provided, and unless otherwise stated, the closing price provided is that of the primary exchange for the issuer’s securities or investments. Information, opinions and estimates contained in this report reflect a judgment at its original date of publication and are subject to change without notice. The price, value of and income from any of the securities or financial instruments mentioned in this report can fall as well as rise. The value of securities and financial instruments is subject to exchange rate fluctuation that may have a positive or adverse effect on the price or income of such securities or financial instruments. MST assumes no obligation to, update this document or correct any inaccuracy which may become apparent after it is given.

The information contained within MST Marquee Research is published solely for information purposes and is not a solicitation or offer to buy or sell any financial instrument or participate in any trading or investment strategy.

Analysis contained within MST Marquee Research publications is based upon publicly available information and may include numerous assumptions. Investors should be aware that different assumptions can and do result in materially different results. Whilst MST makes every effort to use reliable,

comprehensive information in the construction of its reports. MST makes no representation, warranty or undertaking of the accuracy, timeliness or

completeness of information provided to it by third party providers.

Save for any statutory liability that cannot be excluded, MST and its employees, representatives and agents shall not be liable (whether in negligence or otherwise) for any error or inaccuracy in, or omission from, this advice or any resulting loss suffered by the recipient or any other person.

Coverage by MST Marquee Research, including whether to initiate, update or cease coverage of an issuer or sector, is at the sole discretion of the Analyst providing the service.

MST Marquee Research personnel may participate in issuer events such as site visits and are prohibited from accepting payment by the issuer of associated expenses unless pre-authorised by MST.

The research analysts principally responsible for the preparation of MST Marquee Research have received compensation based upon direct client contracting.

For important stock specific disclosures, stock price charts and equity rating histories, please see our website at https://www.mstmarquee.com.au/

Copyright of the information contained within MST Marquee Research (including trademarks and service marks) are the property of their respective owners.

MST Marquee Research, or any portion thereof, may not be reprinted, sold or redistributed without the prior and written consent of MST.