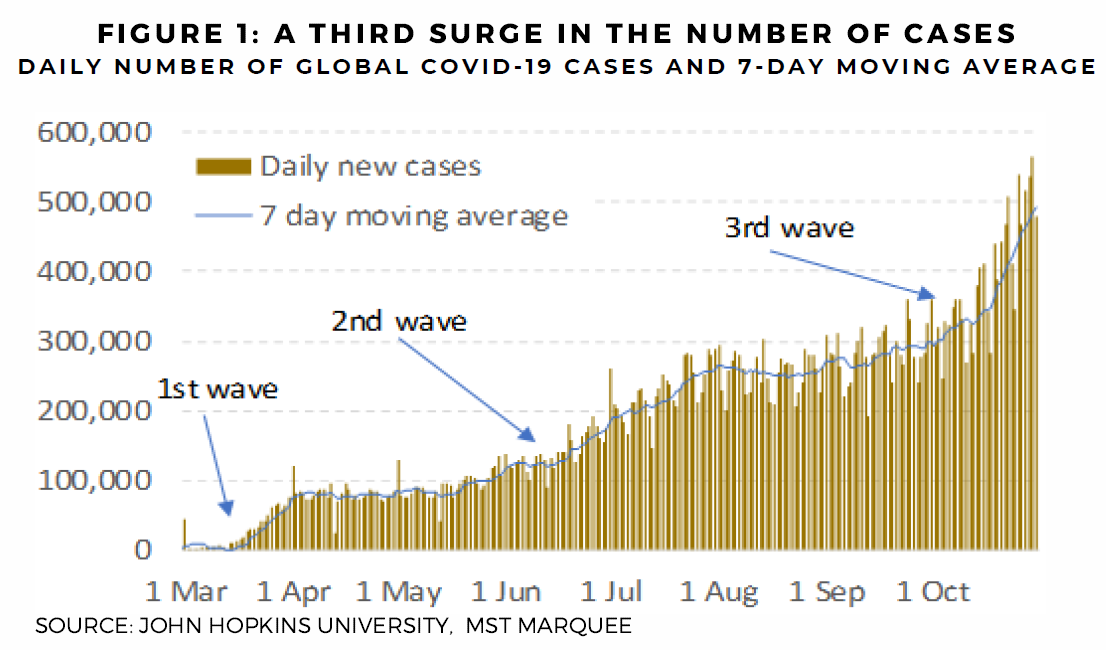

There continues to be a two-steps-forward-one-step-back process in dealing with the pandemic. A rising number of new cases in the northern hemisphere suggests we are currently taking a step back. There are now roughly 500,000 new daily cases of the virus which is a record. The recent increase in the number of cases can potentially be considered the 3rd wave of the virus and, it is causing social distancing restrictions to be implemented once again. With new restrictions we should also expect a slowdown in the recovery the global economy is now enjoying, but it is also becoming clear that humanity is better at dealing with the virus than before. The ‘death rate’ of the virus has continued to fall as treatments have improved and those most vulnerable are self-imposing social distancing measures.

Providing further reason for hope is a vaccine for the coronavirus. Never has the global pharmaceutical industry, with considerable help from governments, concentrated so much capital on just one problem. There are four front runner vaccines and there is hope emergency doses, for healthcare workers and the elderly, will be available before year-end. Communication from the Australian government leads us to forecast most of the domestic population will be able to receive the vaccine before the end of 2021.

While counting in the US election continues it appears Biden will become President and senate control will be retained by the Republicans. As they have done in the past, we expect the Republican senate will be effective in blocking many of the bills put forward by the Democrats including the U$2.2t fiscal proposal which was attempted before the election. Instead senate Republicans have proposed a much smaller $500bn package. While the smaller

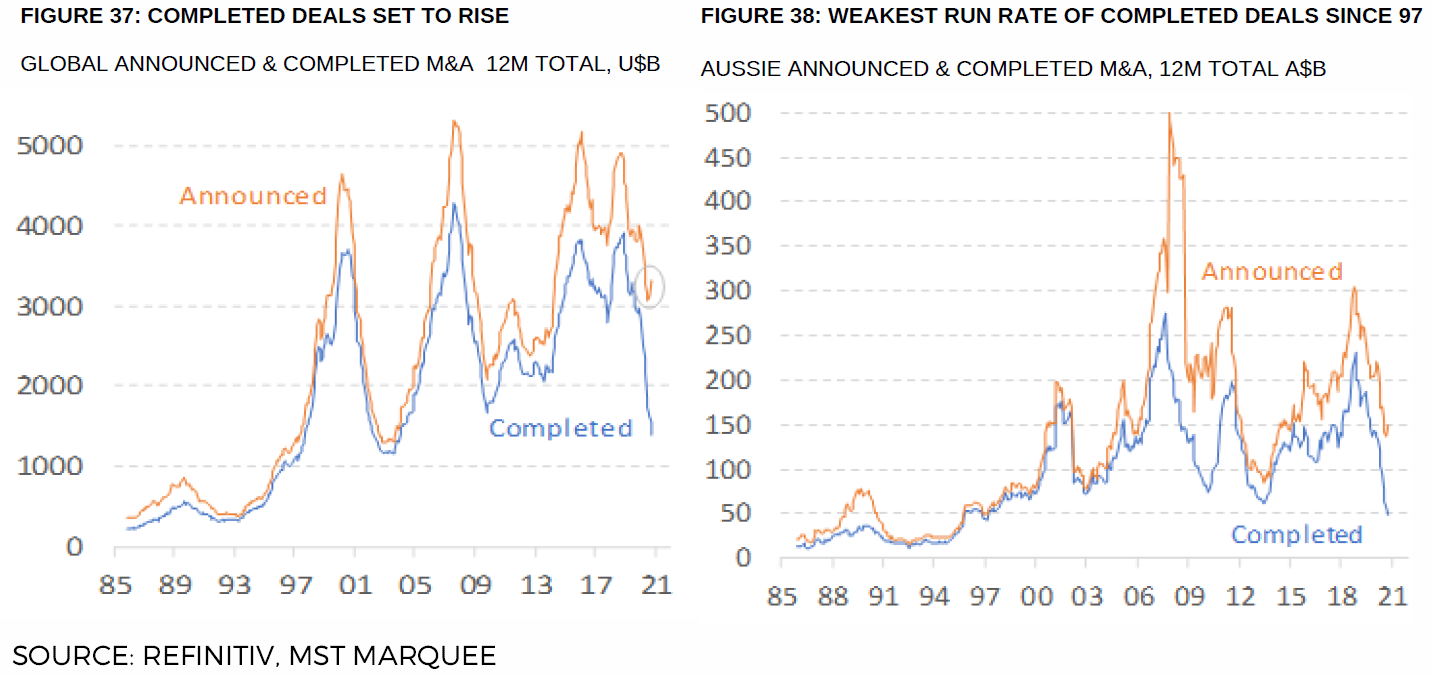

stimulus package will mean US policy makers will miss a chance to broaden and sharpen the burgeoning economic recovery, the change may not necessarily be negative for stock prices. While there will be less fiscal stimulus with a Republican controlled senate, we should expect more monetary stimulus. This will involve an even longer period of lower-for-longer bond yields and discount rates. The consequences of this will be positive for financial assets without immediately being positive for the economy. Lower-for-longer bonds yields will probably result in higher equity valuations, and greater support for ‘growth’ stocks, like the Technology companies. A lower cost of funding should also encourage more M&A activity, of course financed by cheap debt.

The diminished ability to legislate change in the US, should mean some of the policies investors were anticipating, will not eventuate. The Democrats were proposing a carbon neutral electricity sector by 2035 and an adoption of the Paris Agreement. Both environmental proposals would have weighed on fossil fuel production by the US and served to benefit non-US oil & gas companies, in our view.

Also, the Democrats were proposing further restrictions on Financial regulation which would have included a tightening of the Volker rule and supporting Glass Steagall. While the Democrats can still introduce stricter regulation via executive orders, the scope of these will be limited.

Trump has introduced restrictions on immigration via executive orders and we expect a Biden Presidency to reverse these. The travel ban on several Muslim countries will probably also be reversed. These changes will be obvious positives for the housing sector in the US. A Republican senate will no doubt hold up legislative change in the US. Meanwhile, we expect individuals with more orthodox approaches to be appointed to key positions like Treasury Secretary and Governor of the Fed. In the US we are entering a period of policy predictability, in our view. As a consequence ‘hedges’, like gold, are likely to be less popular.

While the outlook for the US economy is in a wait-and-see-mode, in Australia we are witnessing extraordinary coordination by policy makers that will ensure a sharp recovery, in our view. The Australian Treasury announced the biggest fiscal deficit since WW2. At 11% of GDP the budget short fall for FY21 will be almost three times larger than during the global financial crisis 20 years ago. The level of government indebtedness is set to grow precipitously and would have previously been a signal for higher bond yields, but not now. Phil Lowe, Governor of the RBA, followed Frydenberg’s fiscal easing with a promise to ease monetary policy as well. It appears the central bank is set on holding down the cost of funding for fiscal authorities to circumvent free markets. Economists call this financial repression and is it is good for borrowers and bad for savers. We believe the Australian economy will be in a situation of financial repression for several years. Savers need to work harder to find investments that provide an adequate return. The combination of broad fiscal support and uber easy monetary conditions should support domestic demand in Australia.

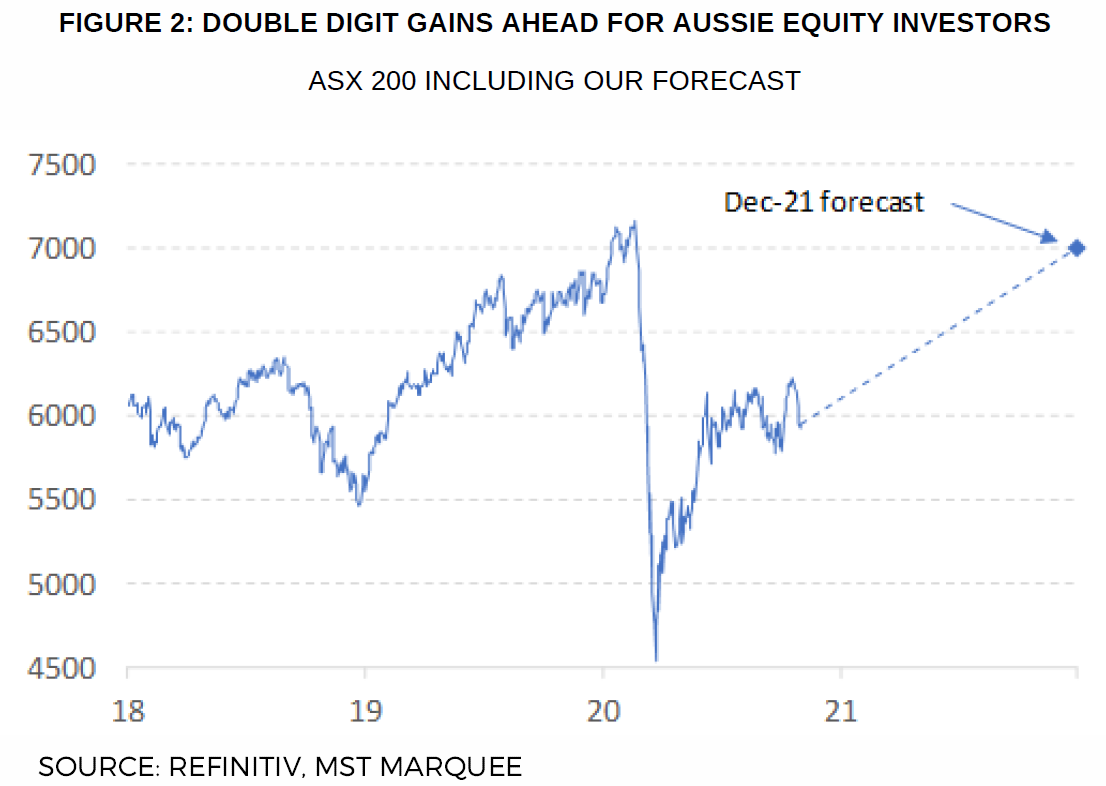

The extraordinary coordination between fiscal and monetary authorities in Australia, provide us with more confidence that Australian corporate earnings will enjoy a V-shaped recovery. We know of the nine previous profit recoveries since 1940 seven were V-shaped, one was a W and another was an L-shaped recovery. There are early signs of a sharp rebound in corporate earnings in Australia with analysts upgrading their outlook and companies restructuring to increase operational leverage to an improvement in revenue. We are forecasting 20% gains in ASX 200 EPS over the coming 12-months and double-digit profit gains for the 12 months following. This is higher than current bottom-up consensus forecasts. Against a backdrop of rising earnings, we believe Aussie equities will continue to rally and introduce our Dec-2021 forecast for the ASX 200 at 7000. This should mean investors enjoy capital gains of 15-20% from here. At 7000 our long-term measures suggest the equity market will be closer to fair value.

The prospect of society learning how to live with the virus, which may involve a vaccine, suggests investors should tilt portfolios towards those stocks set to benefit from a post-COVID economic normalisation. This should include companies which are still suffering from social distancing measures like the gaming stocks, the travel companies, and hospitals. Many of these companies have performed well over the last few weeks but remain attractively priced

when compared to estimates of mid-cycle cash-flows. While the COVID recovery will be good for some companies that have suffered in 2020, it won’t be good for all, in our view. An area we believe will be left behind as the market recovers include the Banks. The behemoths of the Australian equity market face the task of trying to sell more debt to already highly leveraged Australian households. While the banks may appear to be cheap when compared to their

historical valuations, the prospect of achieving historical levels of profitability appear low.

Global M&A activity has been subdued for several months, but now companies are reengaging their animal spirits. We believe we are at the very start of the next M&A cycle and deal activity is set to be supported by cheap funding, still cheap equity valuations, solid balance sheets and a need to restructure given the economic changes wreaked on the global economy by the pandemic. In Australia too, animal spirits have awoken with several large deals announced in the last month. We expect more to come. Our screen of potential targets includes AMP, Ampol, Crown, Downer, Oil Search and, Santos.

MST Marquee outlines that the securities and industries covered in this report, are exposed to broader risks associated with operational, competition,

economic, and political factors. MST Marquee points out, that these factors carry ongoing risk of change and variation, which cannot be accurately forecast or anticipated in all instances. These risks apply to both earnings forecasts and target price. The price and value of investments mentioned and any income that might accrue could fall or rise or fluctuate. Past performance is not a guide to future performance.

This report has been prepared in an independent manner. In uploading the report to the MST Marquee webpage, the analysts certify that the views and

opinions expressed within this report accurately represent their personal views on the subject matter and securities covered in this report. The analysts have not received direct or indirect compensation related to the views or recommendations contained herein.

MST Marquee research is published in accordance with our conflict management policy which is available at: https://www.mstmarquee.com.au/

The information and opinions contained within MST Marquee Research were prepared by MST Financial Services Pty Ltd (ABN 54 617 475 180, AFSL

500557) (‘MST’).

MST Marquee Research is distributed only as may be permitted by law. It is not intended for distribution or use by any person or entity located in a jurisdiction where distribution, publication, availability or use would be prohibited. MST makes no claim that MST Marquee Research content may be lawfully viewed or accessed outside of Australia. Access to MST Marquee Research content may not be legal for certain persons and in certain jurisdictions. If you access this service or content from outside of Australia, you are responsible for compliance with the laws of your jurisdiction and/or the jurisdiction of the third party receiving such content. MST Marquee Research is provided to our clients through our proprietary research portal and distributed electronically by MST to its MST Marquee clients. Some MST Marquee Research products may also be made available to its clients via third party vendors or distributed through alternative electronic means as a convenience. Such alternative distribution methods are at MST’s discretion.

Any access to or use of MST Marquee Research is subject to the Terms and Conditions of MST Marquee Research https://www.mstmarquee.com.au/LiteratureRetrieve.aspx?ID=182307. By accessing or using MST Marquee Research you hereby agree to be bound by our Terms and Conditions and hereby liable for any monies due in payment of accessing this service. In addition you consent to MST collecting and using your personal data (including cookies) in accordance with our Privacy Policy https://www.mstfinancial.com.au/privacy-policy, including for the purpose of a) setting your preferences and b) collecting readership data so we may deliver an improved and personalised service to you. If you do not agree to our Terms and Conditions and/or if you do not wish to consent to MST’s use of your personal data, please do not access this service.

MST Marquee Research is not intended, nor does it constitute a representation that an investment strategy or recommendation is suitable or appropriate

for an investors individual circumstances. MST Marquee Research may not be construed as personal advice or recommendation. MST encourages

investors to seek independent financial advice regarding the suitability of investments for their individual circumstances and recommends that investments be independently evaluated.

Investments involve risks and the value of any investment or income may go down as well as up. Investors may not get back the full amount invested. Past performance is not indicative of future performance, and no representation or warranty, express or implied, is made regarding future performance. Estimates of future performance are based on assumptions that may not be realised. If provided, and unless otherwise stated, the closing price provided is that of the primary exchange for the issuer’s securities or investments. Information, opinions and estimates contained in this report reflect a judgment at its original date of publication and are subject to change without notice. The price, value of and income from any of the securities or financial instruments mentioned in this report can fall as well as rise. The value of securities and financial instruments is subject to exchange rate fluctuation that may have a positive or adverse effect on the price or income of such securities or financial instruments. MST assumes no obligation to, update this document or correct any inaccuracy which may become apparent after it is given.

The information contained within MST Marquee Research is published solely for information purposes and is not a solicitation or offer to buy or sell any financial instrument or participate in any trading or investment strategy.

Analysis contained within MST Marquee Research publications is based upon publicly available information and may include numerous assumptions. Investors should be aware that different assumptions can and do result in materially different results. Whilst MST makes every effort to use reliable,

comprehensive information in the construction of its reports. MST makes no representation, warranty or undertaking of the accuracy, timeliness or

completeness of information provided to it by third party providers.

Save for any statutory liability that cannot be excluded, MST and its employees, representatives and agents shall not be liable (whether in negligence or otherwise) for any error or inaccuracy in, or omission from, this advice or any resulting loss suffered by the recipient or any other person.

Coverage by MST Marquee Research, including whether to initiate, update or cease coverage of an issuer or sector, is at the sole discretion of the Analyst providing the service.

MST Marquee Research personnel may participate in issuer events such as site visits and are prohibited from accepting payment by the issuer of associated expenses unless pre-authorised by MST.

The research analysts principally responsible for the preparation of MST Marquee Research have received compensation based upon direct client contracting.

For important stock specific disclosures, stock price charts and equity rating histories, please see our website at https://www.mstmarquee.com.au/

Copyright of the information contained within MST Marquee Research (including trademarks and service marks) are the property of their respective owners.

MST Marquee Research, or any portion thereof, may not be reprinted, sold or redistributed without the prior and written consent of MST.