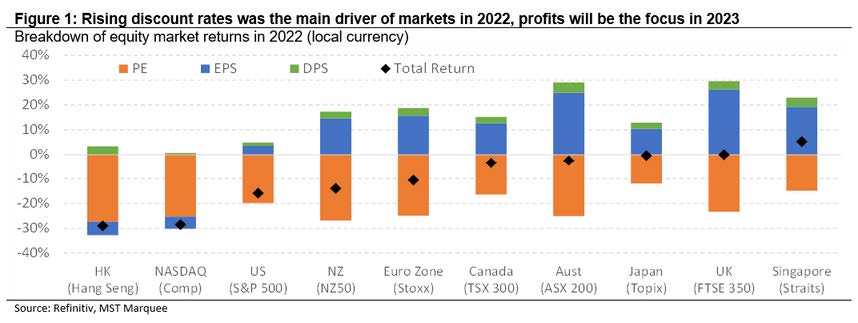

By far the dominant theme in global financial markets in 2022 has been the rise in interest rates and bond yields. Central banks are fighting inflation, they have left it late to do so, and they’ve spent much of 2022 trying to catch-up. The US central bank raised rates in increments of 75 basis points. Not since 1995 has it raised rates by this amount in a single meeting, and that was once. In 2022 we had four of these unusually large rate-rises, all one after each other.

In Australia, the central bank has pushed through four consecutive 50 basis point increases and now have interest rates back to levels last seen in 2014. The sharp increase in interest rates has been felt in other markets. In the US bond market, the bedrock of global discount rates, we find the 10-year bond yield was 4.2% until recently and 270 basis points higher than start of year levels. Never have US bond yields risen so much in a single year.

Driving the cost of money higher has been a combination of surging inflation, solid economic activity, central banks lightening their own positions in government bond markets via quantitative tightening programs and, a litany of other liquidity issues. These liquidity issues include Asian central banks selling US bonds to try and hold up their own currency because they, too, are afraid of surging inflation. Meanwhile, UK pension funds are being forced to sell down their US Treasury positions to make margin-calls back home.

Surging interest rates and bond yields are leaving a trail of disaster elsewhere. In the past it has been the equity market which has collapsed when bond yields have surged. This was the case in the early 2000s and the decline was centered around expensive tech stocks. The S&P 500 sold-off by 50% back then and the ASX 200 was down 22%. Equity markets again crumbled around the time of the financial crisis and after central banks tightened policy. The Australian central bank was considerably more hawkish back then and raised rates as the crisis was kicking off. The Aussie equity market dived more than 50% as did the US equity market. In both the early 2000s and during the global financial crisis equity markets were fragile, a house-of-card perhaps. They were held up by low interest rates but when that went they came tumbling down.

The house-of-cards now, if there is one, is amongst the village of the new assets. They are unregulated, exist for opaque purposes and, spent their infancy in a world of ridiculously low interest rates. Now the price of money is rising and they are struggling. The collapse of FTX is so far the most stunning part of the crypto trainwreck. As long as interest rates remain high, we think there will be more collapses, perhaps less spectacular, in this corner of global finance.

There have also been pockets of the global equity market which have proven to be flimsy in the face of higher interest rates and bond yields. They have been more speculative stocks and include companies which don’t generate a profit. Over the long-term a revolving basket of unprofitable companies in Australia would have generated returns of -20% p.a. (yes that’s a loss) and this year this group of stocks lost investors 35%. The lessons are clear — tread with caution around the most speculative stocks and assets, especially when the price of money goes up.

There have also been pockets of the global equity market which have proven to be flimsy in the face of higher interest rates and bond yields. They have been more speculative stocks and include companies which don’t generate a profit. Over the long-term a revolving basket of unprofitable companies in Australia would have generated returns of -20% p.a. (yes that’s a loss) and this year this group of stocks lost investors 35%. The lessons are clear — tread with caution around the most speculative stocks and assets, especially when the price of money goes up.

While the carnage of rising interest rates and bond yields has been brutal, we expect most of this is now behind us. We forecast moderating bond yields ahead. The decline has already begun and will continue with lower inflation, slower economic & profit growth, the coming end of central bank hiking cycles and, an alleviation of the acute liquidity concerns in government bond markets.

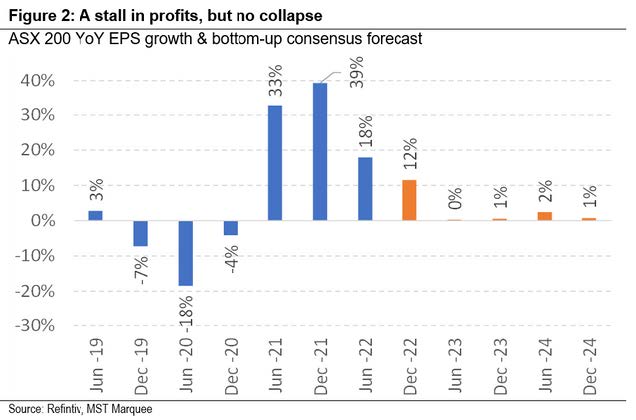

The concern for equity investors in 2023 is likely to revolve around profits. Global profits have made a stunning recovery from the depths of the pandemic. In the US and Australia EPS has increased by more than 60% from their 2020 lows. Now corporate profitability is at elevated levels with US RoEs at 18% and 2 standard deviations higher than the 40-year average. In Australia profitability does not appear as extended and RoEs are at 15% or 1.5 standard deviations higher than the long-term average. Still local RoEs have only been at or above current levels twice in the last 40 years. Despite the vulnerability, for several reasons we don’t forecast a profits collapse. Importantly, policy is currently not tight enough to deliver a broad-based decline in earnings. In the US and Australia real interest rates remain negative. This may change however if central bank decide to keep interest rates high even when inflation is falling rapidly. While this is not our central forecast — central banks appear willing to respond to rising and falling inflation — it does remain a possible scenario. The bottom-up consensus outlook is for 2% EPS growth for the ASX 200 in both the 12 months to June 23 and June 24. Anemic growth rates like this are consistent with our ‘soft-landing’ for corporate profits.

Our forecast is for a modicum of EPS momentum and, a decline in discount rates, which should mean Aussie equities eke out a small gain by the end of 2023. We target the ASX 200 to reach 7400. Our assumptions here include a year-end PE ratio of 14x vs 13.5x now. The long-term average has been 14.5. Our forecasts will prove to be too optimistic in a hard landing scenario. We expect Aussie equities will outperform those in the US where valuations are still more expensive and the profits outlook appears more problematic.

The US equity market lacks the same level of profits support as in Australia. US profitability, in part due to the lockdowns during COVID, are starting this period of vulnerability at an especially elevated level. Meanwhile, while not our central forecast, the sharp rise in US interest rates puts at risk the current slowdown turns into something worse. While weak US profits momentum will have an influence on Aussie earnings momentum too, local earnings are greater beneficiaries from (1) easing policy in China and, (2) a less aggressive central bank. Our preference would be to make bigger allocations to US equities further through the current period of slowing earnings and at, hopefully, a stronger AUD vs USD.

Within the market we continue to target several themes that should help investors deliver better than index returns. We highlight these themes below.

The stimulus taps remain on in China and we expect this will support a recovery in economic activity. The official data suggests a rapid slowdown in the 1H22 and early data for 2H indicates a recovery. The recovery will be supported by a lightening of the COVID restrictions and direct support for the Chinese property market. A China recovery should be positive for the miners and our preferred ones include BHP and Iluka Resources. Rising China steel prices may also support prices in the US boding well for Bluescope.

The time has come to add a little duration to portfolios. Global bond yields have risen to levels beyond our initial forecasts and we believe there are early signs of moderation. We continue to avoid some of the more highly priced and speculative growth stocks where there could be clearer earnings concerns or have no earnings. However, investors should consider former high growth stocks which continue to benefit from solid profits momentum like Goodman Group.

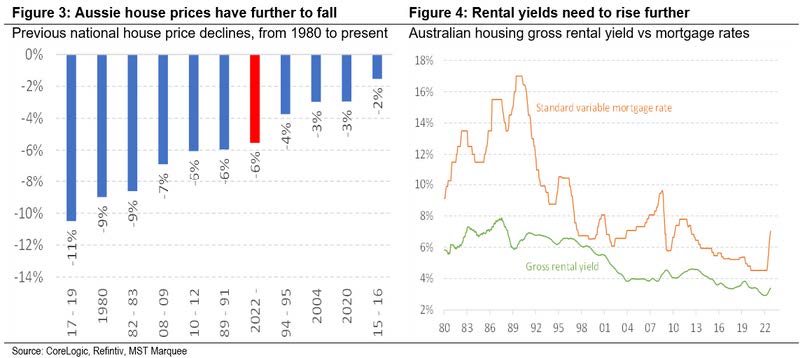

We expect further downside in residential property prices indices driven by weaker lending and higher interest rates. While housing valuations have improved, according to the gross rental yield, higher mortgage rates suggest they will rise further. During previous periods of falling house prices the Banks have been consistent underperformers. We also find the resi-developers, like Mirvac have struggled. Meanwhile, we find Australian household balance sheets are strong which suggests the downside to discretionary consumption will not be as significant.

We expect further downside in residential property prices indices driven by weaker lending and higher interest rates. While housing valuations have improved, according to the gross rental yield, higher mortgage rates suggest they will rise further. During previous periods of falling house prices the Banks have been consistent underperformers. We also find the resi-developers, like Mirvac have struggled. Meanwhile, we find Australian household balance sheets are strong which suggests the downside to discretionary consumption will not be as significant.

MST Marquee outlines that the securities and industries covered in this report, are exposed to broader risks associated with operational, competition,

economic, and political factors. MST Marquee points out, that these factors carry ongoing risk of change and variation, which cannot be accurately forecast or anticipated in all instances. These risks apply to both earnings forecasts and target price. The price and value of investments mentioned and any income that might accrue could fall or rise or fluctuate. Past performance is not a guide to future performance.

This report has been prepared in an independent manner. In uploading the report to the MST Marquee webpage, the analysts certify that the views and

opinions expressed within this report accurately represent their personal views on the subject matter and securities covered in this report. The analysts have not received direct or indirect compensation related to the views or recommendations contained herein.

MST Marquee research is published in accordance with our conflict management policy which is available at: https://www.mstmarquee.com.au/

The information and opinions contained within MST Marquee Research were prepared by MST Financial Services Pty Ltd (ABN 54 617 475 180, AFSL

500557) (‘MST’).

MST Marquee Research is distributed only as may be permitted by law. It is not intended for distribution or use by any person or entity located in a jurisdiction where distribution, publication, availability or use would be prohibited. MST makes no claim that MST Marquee Research content may be lawfully viewed or accessed outside of Australia. Access to MST Marquee Research content may not be legal for certain persons and in certain jurisdictions. If you access this service or content from outside of Australia, you are responsible for compliance with the laws of your jurisdiction and/or the jurisdiction of the third party receiving such content. MST Marquee Research is provided to our clients through our proprietary research portal and distributed electronically by MST to its MST Marquee clients. Some MST Marquee Research products may also be made available to its clients via third party vendors or distributed through alternative electronic means as a convenience. Such alternative distribution methods are at MST’s discretion.

Any access to or use of MST Marquee Research is subject to the Terms and Conditions of MST Marquee Research https://www.mstmarquee.com.au/LiteratureRetrieve.aspx?ID=182307. By accessing or using MST Marquee Research you hereby agree to be bound by our Terms and Conditions and hereby liable for any monies due in payment of accessing this service. In addition you consent to MST collecting and using your personal data (including cookies) in accordance with our Privacy Policy https://www.mstfinancial.com.au/privacy-policy, including for the purpose of a) setting your preferences and b) collecting readership data so we may deliver an improved and personalised service to you. If you do not agree to our Terms and Conditions and/or if you do not wish to consent to MST’s use of your personal data, please do not access this service.

MST Marquee Research is not intended, nor does it constitute a representation that an investment strategy or recommendation is suitable or appropriate

for an investors individual circumstances. MST Marquee Research may not be construed as personal advice or recommendation. MST encourages

investors to seek independent financial advice regarding the suitability of investments for their individual circumstances and recommends that investments be independently evaluated.

Investments involve risks and the value of any investment or income may go down as well as up. Investors may not get back the full amount invested. Past performance is not indicative of future performance, and no representation or warranty, express or implied, is made regarding future performance. Estimates of future performance are based on assumptions that may not be realised. If provided, and unless otherwise stated, the closing price provided is that of the primary exchange for the issuer’s securities or investments. Information, opinions and estimates contained in this report reflect a judgment at its original date of publication and are subject to change without notice. The price, value of and income from any of the securities or financial instruments mentioned in this report can fall as well as rise. The value of securities and financial instruments is subject to exchange rate fluctuation that may have a positive or adverse effect on the price or income of such securities or financial instruments. MST assumes no obligation to, update this document or correct any inaccuracy which may become apparent after it is given.

The information contained within MST Marquee Research is published solely for information purposes and is not a solicitation or offer to buy or sell any financial instrument or participate in any trading or investment strategy.

Analysis contained within MST Marquee Research publications is based upon publicly available information and may include numerous assumptions. Investors should be aware that different assumptions can and do result in materially different results. Whilst MST makes every effort to use reliable,

comprehensive information in the construction of its reports. MST makes no representation, warranty or undertaking of the accuracy, timeliness or

completeness of information provided to it by third party providers.

Save for any statutory liability that cannot be excluded, MST and its employees, representatives and agents shall not be liable (whether in negligence or otherwise) for any error or inaccuracy in, or omission from, this advice or any resulting loss suffered by the recipient or any other person.

Coverage by MST Marquee Research, including whether to initiate, update or cease coverage of an issuer or sector, is at the sole discretion of the Analyst providing the service.

MST Marquee Research personnel may participate in issuer events such as site visits and are prohibited from accepting payment by the issuer of associated expenses unless pre-authorised by MST.

The research analysts principally responsible for the preparation of MST Marquee Research have received compensation based upon direct client contracting.

For important stock specific disclosures, stock price charts and equity rating histories, please see our website at https://www.mstmarquee.com.au/

Copyright of the information contained within MST Marquee Research (including trademarks and service marks) are the property of their respective owners.

MST Marquee Research, or any portion thereof, may not be reprinted, sold or redistributed without the prior and written consent of MST.